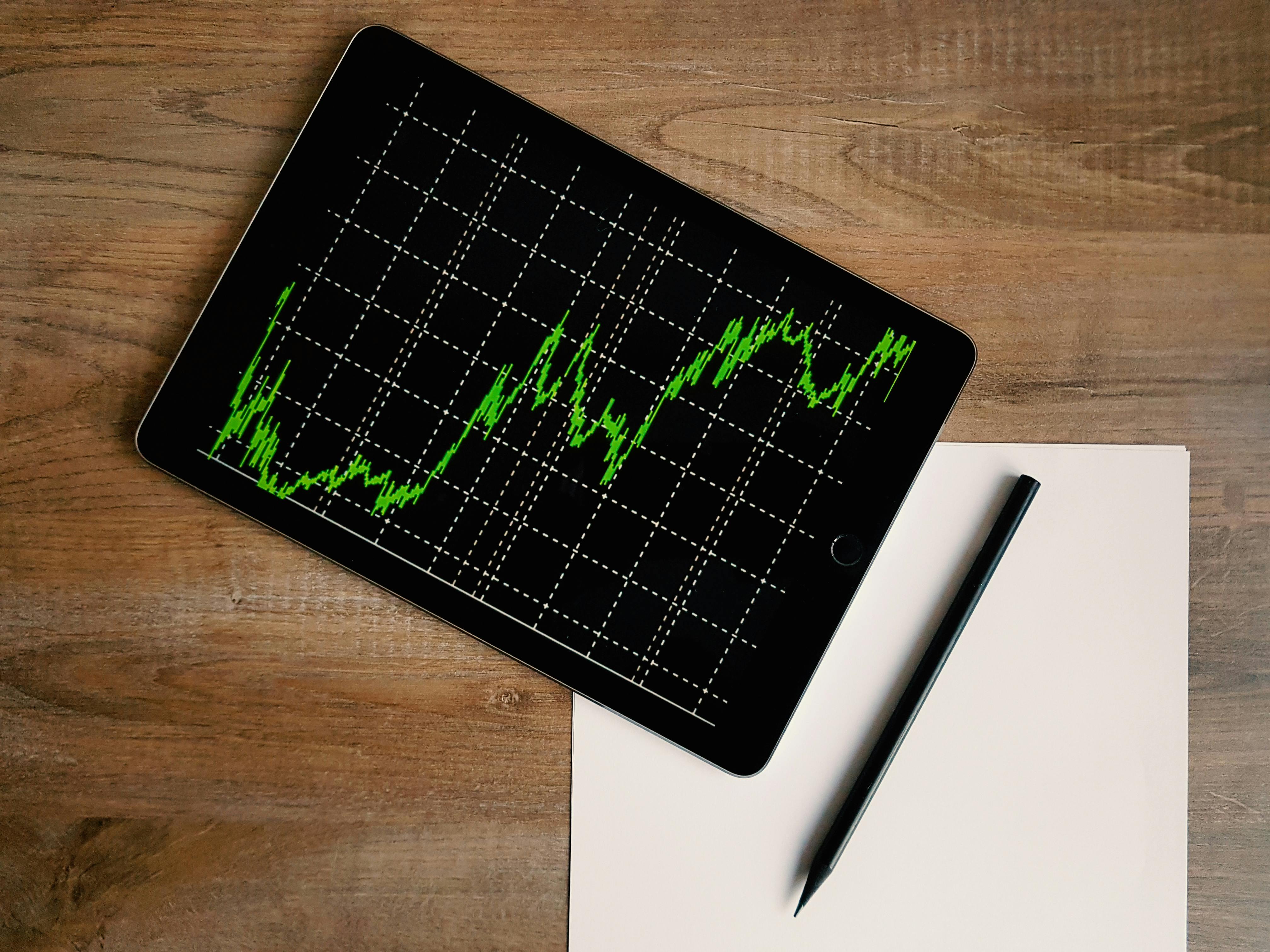

What are Stocks?

A stock represents a share in the ownership of a company, including a claim on the company's earnings and assets. Stockholders are partial owners of the company. When the value of the business rises or falls, so does the value of the stock.

Stocks are generally bought and sold electronically through stock exchanges, the two primary ones in the United States being the New York Stock Exchange (NYSE) and the National Association of Securities Dealers (NASDAQ). While some companies sell stock directly to investors, most only sell stock through a brokerage such as Schwab.

Investors buy and sell stocks for various reasons, including the potential to grow the value of their investment over time, to profit from shorter-term price movements, or to earn an income through dividend-paying stocks. However, keep in mind that the price of a stock can fall as easily as it can rise. Investing in stocks offers no guarantee of making money, and many investors lose money instead.